Tax-Loss Harvesting

Why Tax Loss Harvesting Is Important

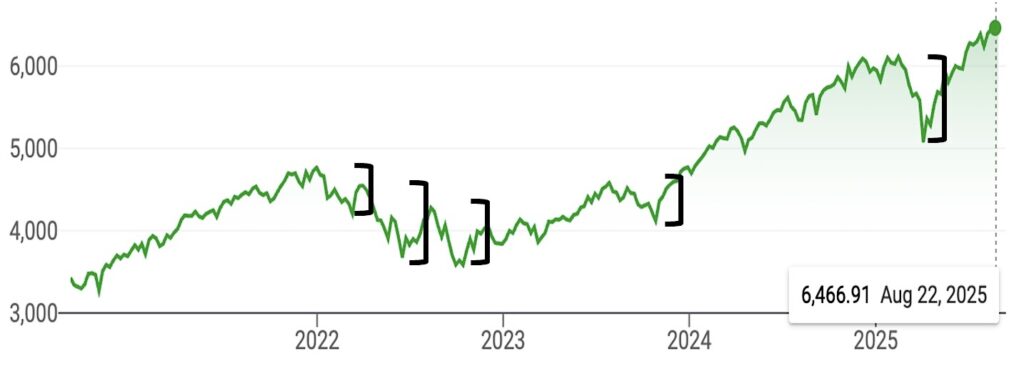

Maximizing returns comes from not only growing wealth but also from effectively managing taxes along the way. 3FI performs tax-loss harvesting to take advantage of market dips by realizing losses when an investment temporarily declines in value. Those realized losses can be deployed to offset taxes on gains, helping clients keep more of what they earn.

3Fi invests in diversified equity funds across US, international developed, and emerging markets. Within each asset class, we invest in multiple funds — such as large-cap, small-cap, and global funds. When a specific investment lot drops in value, we may sell it and immediately replace it with another fund that provides similar asset class exposure, such as swapping an S&P 500 fund for a Russell 1000 fund. This keeps your overall allocation steady, while still capturing the tax benefit of the loss on a specific lot.

Value Creation For Clients

Over the long run, clients stay fully invested in the asset classes that drive growth while also building tax losses that can be used to offset current or future gains. It’s a disciplined, rules-based approach designed to improve after-tax outcomes without altering investment plans that creates value for our clients.

S&P 500 Tax Loss Harvesting Exampled Over Past 5 Years