Portfolio Construction

Can’t Beat the Market

Decades of research shows that it’s a fools’ errand to try beat the public markets. Only 6% of top quintile (20%) performing funds in any year remain in the top quintile two years out. Attempting to beat the market does two harmful things for investors: increases risk (without the ability to outperform) and increases fees for trying.

The Power of Stocks

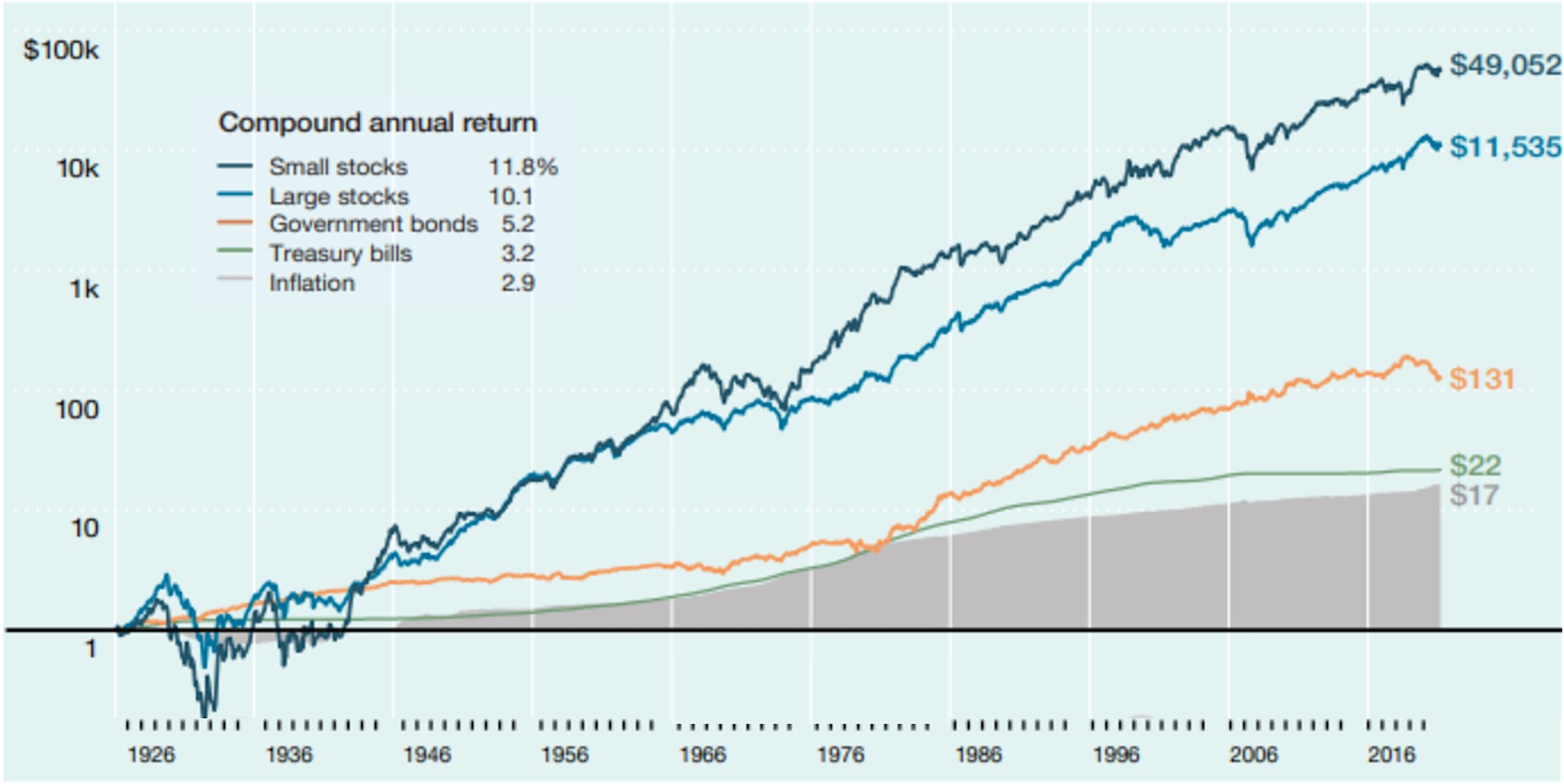

Over the long run, stocks are the best way to grow wealth, generating attractive expected appreciation over mid to longer periods. Importantly, 3FI invests in funds and ETFs that provide diversification, liquidity, and low fees. One dollar invested over roughly 100 years grows to $131 in Government Bonds and instead to $11,535 when invested in Large Stocks, creating massive incremental wealth for investors. Stocks are engines of growth, and over 30-year periods, portfolios with 100% equities have the highest expected return.

The Importance of Fixed Income

Stocks generate growth but face considerable volatility in short/medium terms. Fixed income provides stability and yield, creating balance and greater predictability. Fixed income also allows clients to access funds without having to sell stocks at an inopportune time.

Stocks Outperform in the Long Run

3FI Personalized Portfolios

3FI meets with every new and existing client to understand family circumstances and create a uniquely tailored, optimal portfolio. 3FI invests an appropriate portion of clients’ portfolio in stocks for growth, and sufficient fixed income to provide more stable returns. 3FI constructs these unique diversified portfolios for clients using liquid, low-fee passive funds and ETFs