Opportunistic Rebalancing

The Importance of Rebalancing

Over time, client portfolios stray from target asset allocations as some assets outperform relative to others. As returns of different asset classes diverge, portfolios take on risk inconsistent with risk and return profiles.

Rebalancing puts portfolios back on track by lowering risk, because non-balanced portfolios have proven to be more volatile. Rebalancing provides important discipline and emotional control when markets are most volatile.

Over time, returns generally return to the expected returns for the asset class, also known as regression to the mean. Overperforming assets no longer continue to outperform. No one knows when this will happen, so it’s important to have a rigorous process to manage through these fluctuations.

Rebalancing Can Increase Returns While Lowering Risk

Failure to rebalance not only increases risk but also potentially lowers returns. For example, investors loved the run-up prior to the global financial crisis. Without rebalancing, they faced overexposure to the downturn and likely missed the full rewards from the eventual rebound.

S&P 500 Tax Loss Harvesting Exampled Over Past 5 Years

Using the Calendar Is Suboptimal

Advisors often rebalance based on the calendar, such as the beginning of the year, quarterly, just before a meeting, or not even at all. Unfortunately, using the calendar is suboptimal.

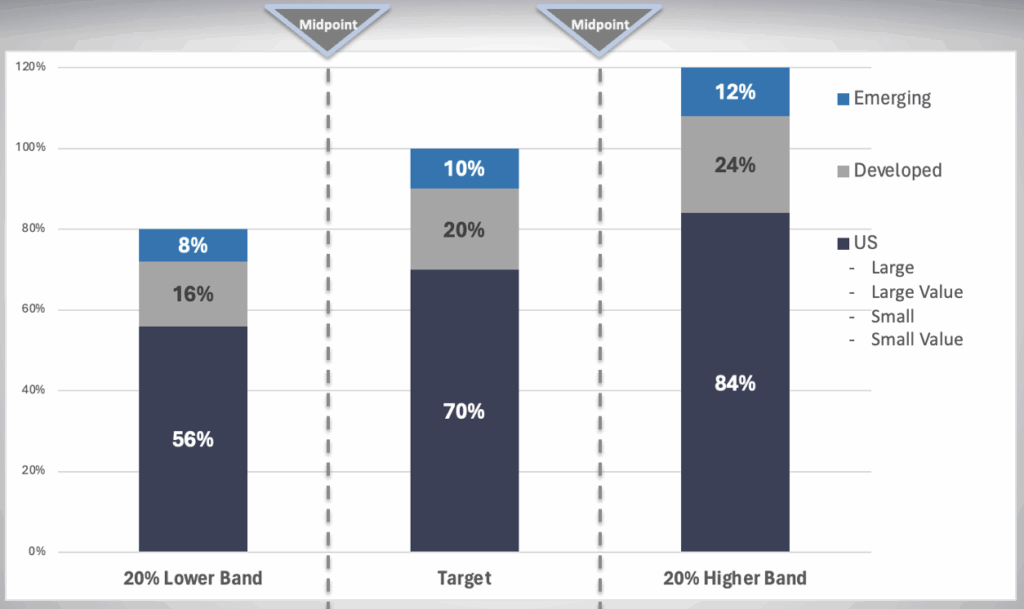

Opportunistic Rebalancing

3Factor deploys a powerful market-based approach called Opportunistic Rebalancing, which has been shown to increase returns in considerable research. 3FI sets specific thresholds above and below each asset class target. 3Factor algorithms identify when an over-performing asset crosses a threshold, reallocating a portion to relatively underperforming assets. Historically, this process of taking a portion of gains and reinvesting in underperforming assets increases returns. Importantly, 3FI only sells half of the portion over the target, leaving over-exposure above the target but trimmed with specific amounts redeployed. Historically, this approach increases clients’ returns over simple passive investing.